Independent risk management consultancy for asset and wealth managers

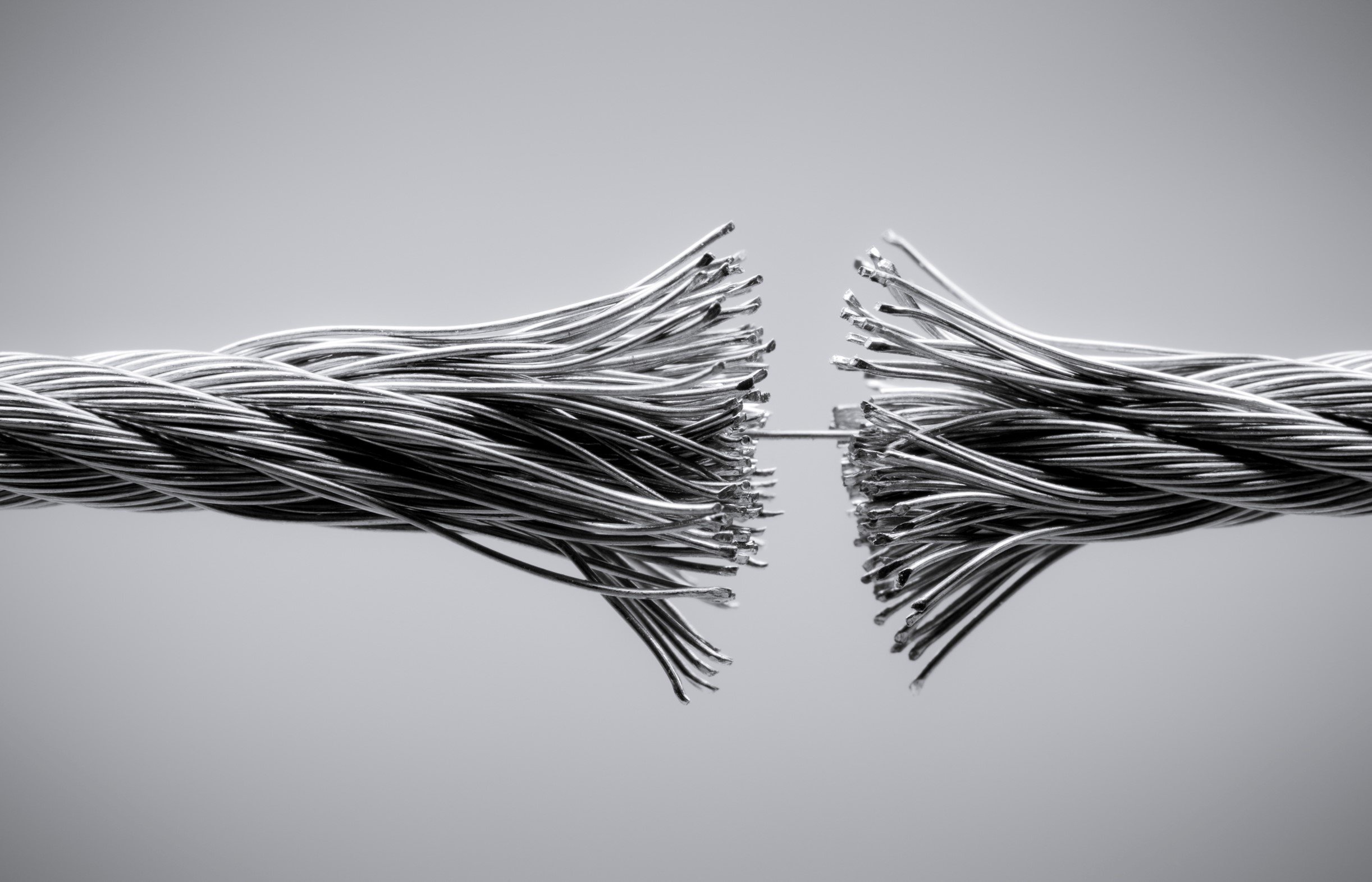

Are you facing challenges in Risk Management?

Working in risk management is interesting, challenging, exciting and ever-changing. However, we all know it can also be tough. Erasmus Risk Consulting exists to provide support to Senior Management, CROs and Heads of Risk (and their teams).

We offer support and 20+ years risk management experience when resources are constrained, by advising on flexible solutions that help to meet ever-changing demands. In order to create time for risk managers and help senior managers meet their heightened responsibilities under SM&CR.

At Erasmus Risk Consulting we know that:

Regulatory responsibilities for risk management are continuing to increase and the remit of Risk functions are expanding.

Senior Risk Managers are being squeezed from all directions. From headcount and budget constraints, increasing demands on time, broadening remits of the risk functions, stakeholders being too busy to engage and heightened regulatory responsibilities / accountabilities, clients and investors requiring greater assurance.

There is a need to manage the risks of the business more efficiently and for companies to extract the value from risk management being done well. It can no longer be a box-ticking exercise where only the bare minimum is achieved.

Smaller and medium size organisations struggle to justify the expense of a fully resourced risk management function.

Yes, it is a challenging time for the industry, companies, Chief Risk Officers (CROs) and Heads of Risk. Due to finite resources, increasingly complex products, fast-moving markets, fee compression, rising costs and greater regulatory demands.

Could your organisation benefit from an additional 20+ years risk management experience and the extra capacity an independent consultant provides in order to meet your risk management responsibilities?

Our Approach

Good risk management practices enable Senior Management to make better risk-informed decisions at a time when their responsibility and accountability has increased markedly. This requires establishing and embedding robust and pragmatic risk management practices (that are instilled within the culture of the organisation) and which offer benefits to the business rather than solely being in place to minimise the downside.

After an initial planning phase and a review of what already exists, we collaborate with your existing leadership and teams to understand the different views, think collectively in a creative way and agree a process to take things forward. This will assist in prioritising conflicting demands and deliver on-going improvements in areas that will support decision-making and help your business realise its strategic aims, rather than just being a box-ticking exercise where the minimum is achieved.

Our support with 20+ years of risk management experience can come in the form of:

offering experienced resource for short periods of time to meet specific needs;

developing and delivering risk training;

completing discrete pieces of work and reporting to the appropriate Forums or Committees; and

supporting the Risk function by enhancing to the existing capacity and capability within the function.

Our approach is underpinned by the core values of Erasmus Risk Consulting, which are:

Pragmatism - Any solution or proposal needs to be sensible, commercially viable and add value to your business.

Collaboration - We achieve more by working together and utilising expertise.

Open-mindedness and curiosity - No one has a monopoly on good ideas, so by listening and learning we can draw contributions from a wider variety of sources in order to get the best outcomes.

Integrity - Being honest, straightforward and delivering what was agreed, when it is agreed.

Challenge - Asking questions and probing the responses and the underlying assumptions, in order to grow, learn and improve.

Why good risk management is important to you and ALL of your stakeholders.

Good risk management can……

ensure you meet the regulatory expectations with regards to how firms manage their risks at a time when regulatory scrutiny is increasing;

reduce your capital provisions (and thus reduce the drain on your capital resources);

minimise financial losses and the non-financial impacts of risk events (when they occur);

empower your organisation to embrace opportunities;

improve internal decision-making because fuller and more relevant information becomes an input into the process;

provide assurance to your key stakeholders (i.e. clients, partners, shareholders, regulators, senior management and employees); and

support your business in achieving its strategy and objectives.

Good risk management should not be seen as an inhibitor for good business management, when done well it complements the effective running of your business.

Reflect on this important question….

Is your organisation equipped and supported to manage risk well? The key is to educate, enable and empower all parts of your organisation to make risk-informed decisions while providing assurance to your stakeholders. This requires appropriate and proportionate risk management being in place, so that your business is protected, supported and able to take risk when opportunities arise.

We can reduce your risk management concerns, both in terms of implementing or responding to changes and also with regards to day-to-day management. We guarantee an approach and a solution that will allow you to demonstrate improved risk management.

Reach out to us at Erasmus Risk Consulting for an initial conversation to discover how we can support you and your business.

No obligation, just the opportunity to reflect on the issues you need to prioritise .